You managed a host of challenges through the shutdown, kept engaged with your members, worked hard to make necessary safety changes to your club, and now you’ve reopened your doors. It’s exciting to see your members coming in again, good to have your staff back doing what they do best. Good to be doing what you do best.

The worries aren’t over of course. If your reopening goes like some other recently reopened gyms, at the end of your first week you may have had only 10-30% of members check-in, cancellations may be twice or more normal rates, 10% or more of memberships still frozen, and anticipated revenue still down 50% or more (much more in some cases). There’s a surprising burst of new membership sales, but it’s unclear whether this is a trend or merely a short-term release of pent-up demand.

Wise voices out there keep reminding you to treat this like you’re opening a new gym. That you need to be a new gym, because it’s a new world. That actually makes it harder than opening a new gym. At least with opening a new gym in the “old world” you had a good idea of what to expect, either based on your own experience or the myriad gym opening resources and experts available to you. This is new to everyone, and everyone is scrambling to figure it out on a day-to-day basis. Doing that well requires data.

I’ve written previously about the importance of using member data analytics to identify high value, highly engaged members for pre-reopening engagement, and closely tracking the behavior of those members upon reopening. Now that you’ve reopened, you’ll want to assess the quality of your returning members (especially if it’s only 10-30% of them) to assure you’re successfully drawing back your highest value members.

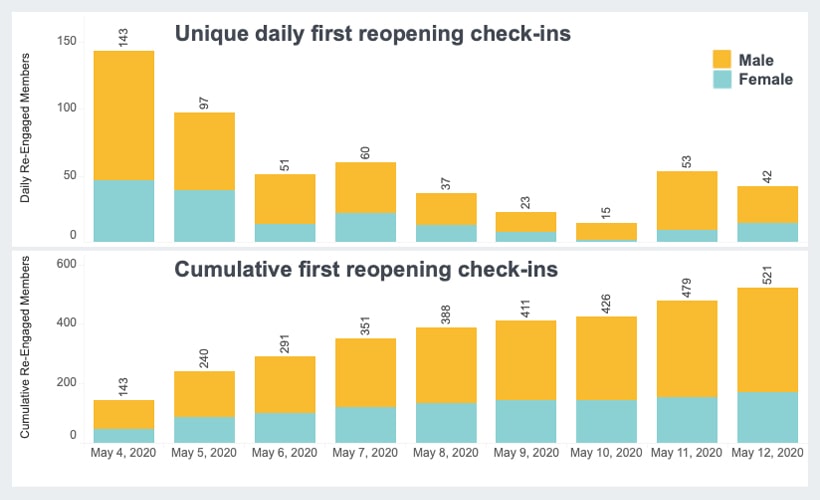

Tracking reopening first check-ins can also provide early warnings of potential issues you may need to address. For example, below are some early first check-in results for a club location that opened on May 4, segmented by member gender.

Tracking reopening first check-ins can also provide early warnings of potential issues you may need to address. For example, below are some early first check-in results for a club location that opened on May 4, segmented by member gender.

From day one, female members have accounted for less than 1/3 of the daily unique first reopening check-ins, and the cumulative bottom graph shows that growth in reopening first check-ins for female members has nearly flatlined after 9 days. Given the club’s gender distribution, this was unexpected.

Is it due to loss of certain amenities or fitness classes due to restrictions? Something in your reopening messaging? With our member analytics it’s easy to pull a list of previously highly engaged female members who haven’t logged a first check-in and reach out with phone call or survey to identify the issue. Without member analytics, how long would this club have gone without realizing this? How many cancellations could have resulted? What kind of word-of-mouth damage could have been done?

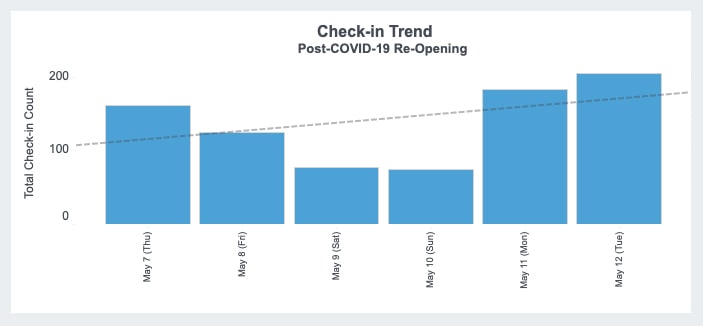

Merely looking at overall check-ins could be misleading too. Below is a chart from the same club showing overall check-ins since reopening, with a trend line showing a promising upward trend. Contrast with the downward trend of new check-ins shown above, it’s clear that much of the check-in growth right now are members with multiple check-ins.

Merely looking at overall check-ins could be misleading too. Below is a chart from the same club showing overall check-ins since reopening, with a trend line showing a promising upward trend. Contrast with the downward trend of new check-ins shown above, it’s clear that much of the check-in growth right now are members with multiple check-ins.

Multiple check-ins are great, of course, but the club has still only won first reopening checkins from less than 15% of its members after 9 days (% members re-engaged is another KPI you should be tracking). You’ll want to focus heavily on winning first reopening check-ins, just like you would with onboarding a new member, but don’t stop there. The second check-in is just as important, maybe even more so.

Why? Remember, you’re a new club now, and people are expecting you to be a new club. Your returning members haven’t had the benefit of a club tour like previous new members, so in a way that first check-in is a lot like a club tour. We’ve even heard anecdotal reports from some gyms of members checking in to just take a look. Not to work out, but just to take a look. You’re making a first impression, and winning a second reopening check-in often depends upon the success of that first impression.

We’ve created specialized reopening analytics allowing clubs to quickly identify members who have logged a first reopening check-in, but have not logged a second check-in within an expected interval based upon analysis of their pre-pandemic check-in patterns. You can use this to identify patterns or trends based on demographics or membership types. You can extract filtered lists of high value members in that segment for outreach or surveying.

Just as I wrote about the importance of not neglecting or giving up on high value cancelled members, you don’t want to neglect your single check-in members for very long. You can’t truly consider them successfully re-engaged until you win at least a second check-in.

Want to learn more?

Fill out the form and a member of our team will be in-touch.